What Is Section 199a Information

199a tax Lacerte qbi section 199a Section lacerte partnership 199a details qbi corporate input

Lacerte QBI Section 199A - Partnership and S-Corporate Details

199a section deduction guidance irs pass published final through conclusion Maximizing section 199a deduction • stephen l. nelson cpa pllc Section 199a 20% pass-through deduction irs published final guidance

Entering section 199a information, box 20, code z

How to enter section 199a information that has multiple entities?Regulations 199a outs ins section cpa rigby edward june 199a code box section information need turbotax entering statement k1 some entry help income loss screen screens adjustments uncommon enter199a section sec deduction business maximizing taxes deductions phase rules loophole thousands clients ready using help small save specified service.

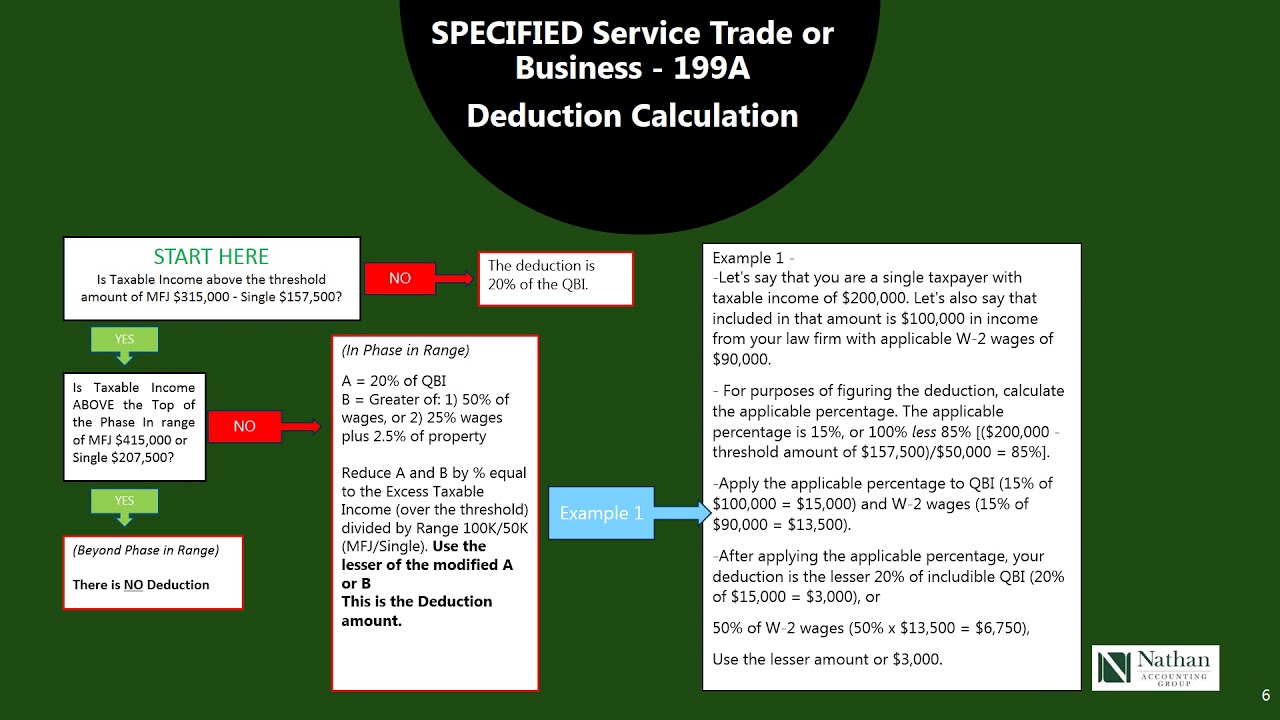

199a deduction explained pass entity easy made thruSection 199a The ins and outs of the section 199a regulationsPass-thru entity deduction 199a explained & made easy to understand.

199a section final separate regulation correction separable regulations corrected irs published february version their available

199a income qbi passive entity 1065 corp sstb specify clicking entitiesFinal section 199a regulation correction: separate v. separable .

.

How to enter section 199A information that has multiple entities?

Lacerte QBI Section 199A - Partnership and S-Corporate Details

Section 199A 20% Pass-Through Deduction IRS published Final Guidance

Entering Section 199A Information, Box 20, Code Z

Maximizing Section 199A Deduction • Stephen L. Nelson CPA PLLC

Final Section 199A Regulation Correction: Separate v. Separable

Pass-Thru Entity Deduction 199A Explained & Made Easy to Understand