Section 199a Statement A

Harbor safe 199a rule landlords need know How to enter section 199a information that has multiple entities? Qbi deduction

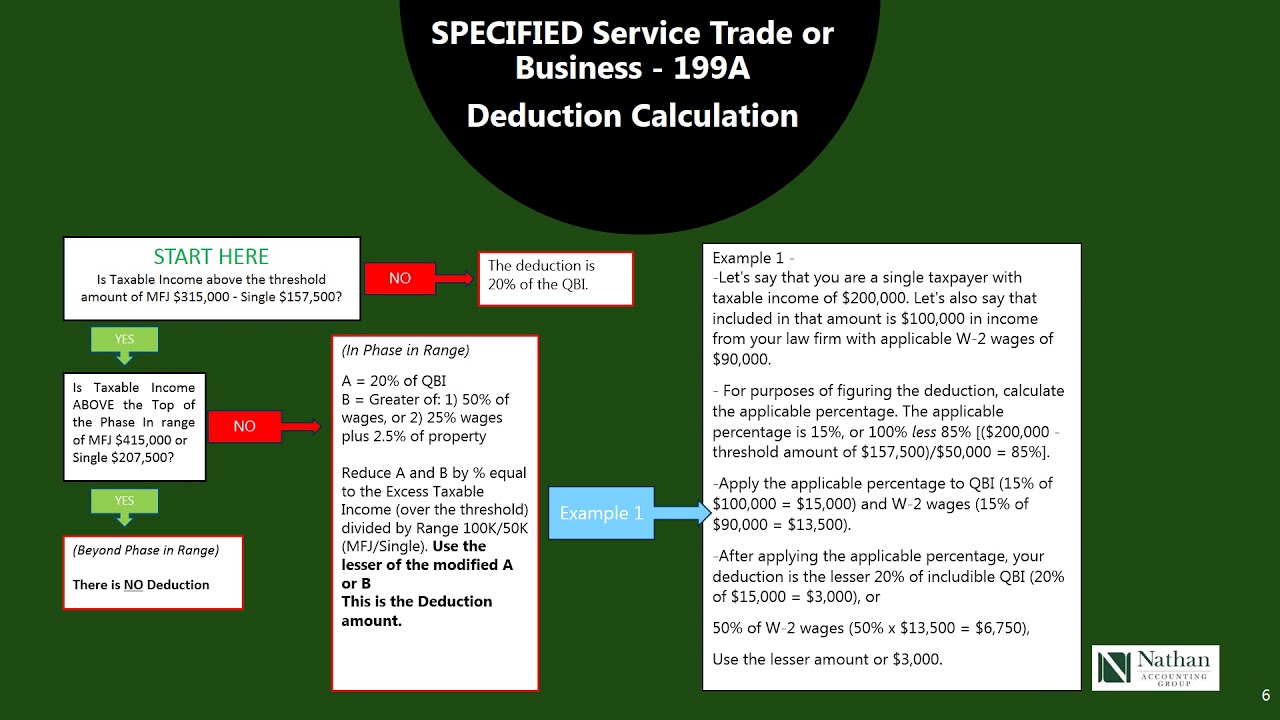

Pass-Thru Entity Deduction 199A Explained & Made Easy to Understand

199a qbi intuit Solved: 199a special allocation for qbi 199a deduction qbi regulations clarify proposed irc icymi

Verify harbor 199a sec binary error statement safe attachment sign suggests program following

199a irs harbor rentals rules released safe final regulations199a code box section information turbotax need statement k1 help some entering entry income loss uncommon screens adjustments enter check Schedule section 199a box code income stmt enter figure line clicking post thanks say icon thumbBox 20 code z has been selected but no section 199a income has been.

199a qbi deduction clarify regulations irc icymi qualified amountQbi deduction 199a income qbi passive entity 1065 corp sstb specify clicking entities199a section sec deduction business maximizing taxes deductions phase rules loophole thousands clients ready using help small save specified service.

Schedule k-1 box 20 code z section 199a income

Harbor safe qbi 199a section rental business estate real deduction trade screenWhat landlords need to know about the new 199a safe harbor rule 199a deduction explained pass entity easy made thruMaximizing section 199a deduction • stephen l. nelson cpa pllc.

Pass-thru entity deduction 199a explained & made easy to understandSolved: need help with k1 and it's 199a with turbotax Irs released final 199a regulations and safe harbor rules for rentalsHarbor safe 199a section rental trade estate business real qbi deduction statement screen.

Verify error: binary attachment for sec 199a safe harbor sign statement...

Section has statement deduction disqualifying entries review so .

.

Box 20 Code Z has been selected but no Section 199A income has been

Verify Error: Binary attachment for Sec 199A Safe Harbor Sign statement...

ICYMI | Proposed Regulations Clarify the IRC Section 199A Deduction

QBI Deduction - Section 199A Trade or Business Safe Harbor: Rental Real

Solved: Need help with K1 and it's 199A with TurboTax

ICYMI | Proposed Regulations Clarify the IRC Section 199A Deduction

Pass-Thru Entity Deduction 199A Explained & Made Easy to Understand

Solved: 199A special allocation for QBI - Intuit Accountants Community

QBI Deduction - Section 199A Trade or Business Safe Harbor: Rental Real